work opportunity tax credit questionnaire social security number

Completing Your WOTC Questionnaire. Below you will find the steps to complete the WOTC both ways.

W 2 Form Fillable Printable Download Free 2021 Instructions Formswift

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment.

. WORK OPPORTUNITY TAX CREDIT Quick Reference Guide for Employers REQUEST Did you know that in 2020 State Workforce Agencies issued 16 million certifications to employers seeking a Work Opportunity Tax Credit WOTC. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. I dont feel safe to provide any of those information when Im just an applicant from US.

We need your help. Number of Views 27312K. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The tax credit itself is equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs.

Enter the applicants name and social security number as they appear on the applicants social. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Number of Views 129K. Asking for the social security number on an application is legal in most states but it is an extremely bad practice.

The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are based on age. What is the Work Opportunity Tax Credit. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal.

By creating economic opportunities this program also helps lessen the burden on other government assistance programs. The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF. 114-113 the PATH Act reauthorizes the WOTC program and Empowerment Zones without changes through.

Questions and answers about the Work Opportunity Tax Credit program. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and state tax credit programs.

Work Opportunity Tax Credit WOTC Frequently Asked Questions. It also says that the employer is encouraged to hire individuals who are facing barriers to employment. Generally an employer elects to take the credit by filing form 5884 work opportunity credit.

My mom wont give me my social security number because she doesnt trust the site. Employers can verify citizenship through a tax credit survey. PdfFiller allows users to edit sign fill and share their all type of documents online.

The Protecting Americans from Tax Hikes Act of 2015 Pub. The work opportunity tax credit wotc is a. It asks for your SSN and if you are under 40.

Its asking for social security numbers and all. Its called wotc work opportunity tax credits. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program.

Most controversial is the practice of employers asking for social security numbers from every applicant whether the individual will receive further consideration or not. Correcting Your Completed Forms. Is participating in the WOTC program offered by the government.

However when the worker already has a TIN taxpayer identification number or Social Security number the employer doesnt need to verify citizenship. Im trying to apply for a part-time retail job over the summer. There are two sets of frequently asked questions for WOTC customers.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. Page one of form 8850 is the wotc. Social Security Number - With this integration ADP will collect the candidates Social Security Number at the time the candidate is completing the WOTC survey.

Ad Download Or Email Taxpayer Qnr More Fillable Forms Register and Subscribe Now. This tax credit program has been extended until december 31 2025. Employers will earn 25 if the employee works at least 120 hours and 40 if the employee works at least 400 hours.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Get answers to your biggest company questions on Indeed.

Asking for the social security number on an application is legal in most states but it is an extremely bad practice. They DOL has a handy WOTC Calculator to see how much your business can earn. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP.

Work opportunity tax credit 1. Fill in the lines below and check any boxes that apply. Work Opportunity Tax Credit Questionnaire Social Security Number.

The application asks for my Social Security Number but I feel uneasy providing it this early in the job application process considering that identity theft is on the rise. The forms require your identifying. Employers must apply for and receive a.

The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. The forms require your identifying information social security number to confirm who you are and they ask for your date of birth because some of the target groups are based on age.

Online application is redirecting me to a questionnaire thats asking for my Social Security Number. Please complete the attached form by following the instructions provided. Complete only this side.

Some states prohibit private employers from collecting.

Leo Work Opportunity Tax Credit

Work Opportunity Tax Credit Department Of Labor Employment

Leo Work Opportunity Tax Credit

Social Security Policy For The Next Administration And The 117th Congress The Heritage Foundation

Work Opportunity Tax Credit What Is Wotc Adp

American Opportunity Tax Credit H R Block

Work Opportunity Tax Credit What Is Wotc Adp

Publication 974 2021 Premium Tax Credit Ptc Internal Revenue Service

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1144541711-111b0ab2182848498ec783fa6d5bbd35-b749d033009a41a2903348e46f7bde60.jpg)

How Does The Work Opportunity Tax Credit Work

Talent Report Employment Equifax Workforce Solutions

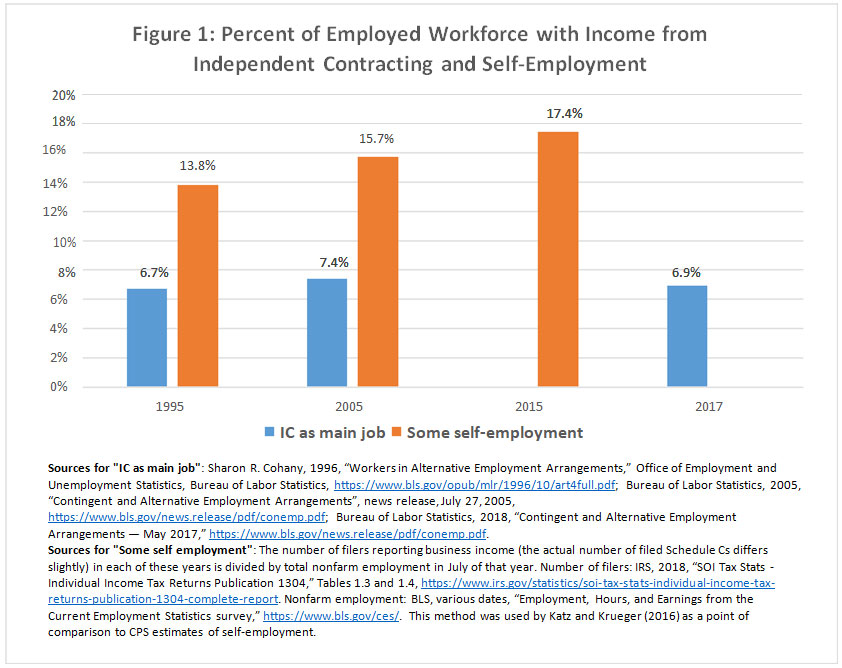

Social Security And Independent Contractors Challenges And Opportunities National Academy Of Social Insurance

Work Opportunity Tax Credit What Is Wotc Adp

Amazon Com Tops 8 1 2 X 11 Inch Employee Application 50 Sheet Pads 2 Pack 32851 Personnel Forms Office Products

Work Opportunity Tax Credit What Is Wotc Adp

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities